You can rating a beneficial HELOC, house security mortgage or bucks-aside re-finance which have a paid-away from domestic, nevertheless is sold with a trade-regarding. House collateral issues can help you borrow against your home for the cash you prefer, nevertheless need certainly to chance your property due to the fact security.

On this page:

- Getting Equity out of a property You have Paid

- Advantages and disadvantages out of Borrowing Up against Your house

- 5 Points to consider Ahead of Tapping into Equity

Well-done, you did they! You've reduced your residence without extended have the burden out of a month-to-month mortgage repayment to worry about. However you would like money having a massive unforeseen bills, property renovate or any other mission. If your deals fall short of one's amount you prefer, think about your alternatives, also household collateral situations.

You could potentially utilize the good-sized house security in case your family are reduced having property equity mortgage otherwise collection of borrowing from the bank (HELOC). Prior to choosing so it street, meticulously weighing the pros and you will disadvantages out-of credit facing your house.

Ways to get Collateral away from a property You've Paid off

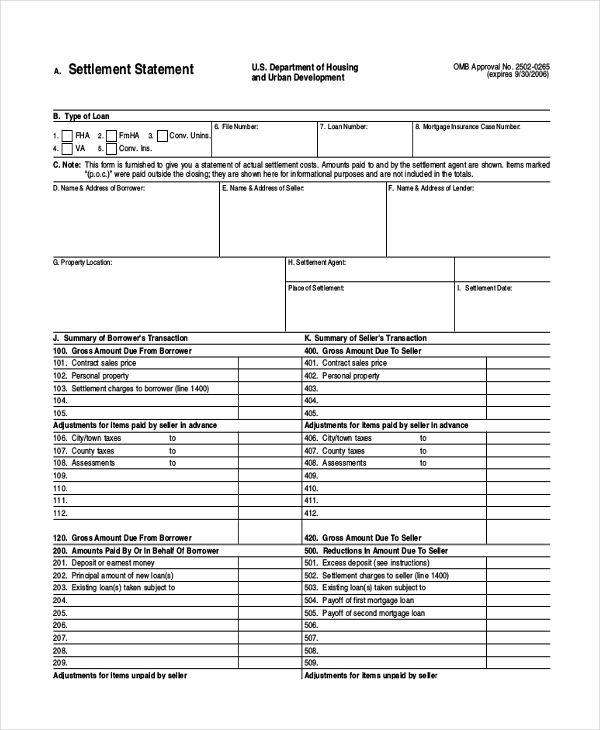

You possess your property outright, which means you possess 100% collateral. Really lenders enables you to use as much as 80% so you can 85% of your guarantee of https://paydayloancolorado.net/north-washington/ your property without your home loan harmony. With a good $0 mortgage harmony, you might be entitled to acquire to 85% of the home's guarantee. This means should your home is well worth $450,000, you may want to borrow to $382,500 ($450,000 x 85%).

- Domestic security mortgage:Family security finance is actually fixed-price payment money that usually allows you to acquire around 80% of your own residence's collateral, however some online finance companies and you can credit unions continue the new limit so you're able to 100%. In the event that acknowledged, you'll get one swelling-sum percentage you need for virtually any mission and you may repay the loan into the fixed monthly installments. Particularly HELOCs, domestic equity funds are believed next mortgage loans as they are new next lien (just after much of your financial) against your property, which functions as collateral to your financing. However, instead an existing financial, these domestic guarantee mortgage items get to be the first lien facing your assets.

- Domestic collateral credit line (HELOC): An effective HELOC works such as a credit card, letting you obtain as frequently and also as often since you such as for example to your own borrowing limit. That it revolving personal line of credit constantly comes with adjustable rates and you will is sold with a suck months, usually ten years, when you could mark on your own credit line because required and also make notice-merely repayments. Due to the fact mark several months ends, you can go into a repayment period. You can easily not any longer manage to withdraw bucks, and you'll possibly need pay the loan-fundamentally more than 2 decades-otherwise refinance the borrowed funds.

- Cash-aside re-finance: An earnings-away re-finance makes you move your residence security for the bucks. Generally, a finances-out refi pertains to substitution your current home loan with a brand new, huge one and making use of the excess to settle financial obligation, defense a home renovate and almost every other judge goal. But if you individual your property outright, there is no newest mortgage to repay, to have the entire amount borrowed-always up to 80% of residence's value-once the dollars.

Positives and negatives of Credit Against Your residence

Experiencing your residence equity can help you address an immediate economic you prefer, nonetheless it could have effects. Prior to getting that loan on a paid-out of family, weigh the huge benefits and you can downsides so you can improve better decision.

Benefits of Credit Up against Your home

- You can access your readily available equity. Getting a paid-out-of house results in there are not any liens on your property. The reduced chance could make it more convenient for a loan provider to agree your to possess a home security financing otherwise HELOC.

Leave a Reply