Review of Oregon Mortgage loans

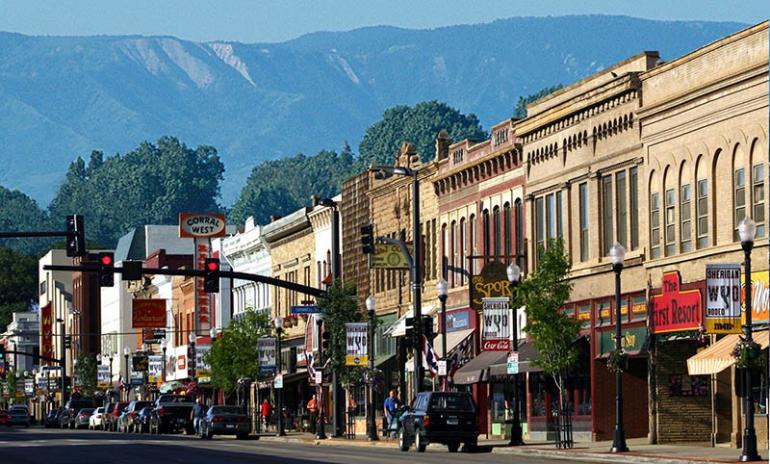

Having its shores, epic woods and you can tough mountains, Oregon certainly makes for an inspiring spot to call house. For these thinking of buying, Oregon mortgage costs are lower than national mediocre pricing. Oregon's counties' compliant financing restrictions stick to the country's standard, when you're FHA limits vary more.

Federal Mortgage Cost

- Oregon home loan calculator

- Oregon property fees

- Oregon old-age taxes

- Oregon taxation calculator

- Find out more about mortgage prices

- How much cash home do you afford

- Determine month-to-month home loan repayments

- Infographic: Ideal urban centers to obtain a mortgage

Oregon Mortgage loans Assessment

The latest compliant restriction for every Oregon condition 's the basic $726,two hundred. New FHA financing limitations pick way more variation, no matter if, between the base amount of $472,030 right to $690,000.

That important thing having Oregon homebuyers to note is the fact that condition does not require lenders to get a legal purchase so you're able to foreclose towards the property. The reason being customers about county are typically given a beneficial deed regarding believe in place of home financing. Deeds from believe are apt to have what is called an excellent fuel of deals term. Consequently if you were to fall behind on the home loan repayments and your lender desires foreclose in your house, they're able to only get a third party so you can auction the house or property.

Yet not Oregon is a low-recourse county. Consequently when your house is purchased in foreclosures and you can there was an improvement ranging from how much you reside worth otherwise costs additionally the amount still owed on the home loan, you are usually not liable for you to definitely economic difference.

Oregon providers should provide customers which have assets disclosure statements. These statements should include information regarding sewage convenience, insulation, the caliber of our home design and you may preferred welfare for example homeowners' connection charge.

30-Seasons Repaired Home loan Rates in the Oregon

A reputable financial choice is a thirty-12 months fixed-rate mortgage. It is especially prominent getting customers exactly who be prepared to stay in the digs to your long haul. Having a thirty-seasons fixed-rates mortgage, you've got three decades to repay the borrowed funds, unless you build prepayments or refinance. The pace remains the exact same throughout the latest loan that makes it some time easier for homeowners to help you finances its monthly premiums as they constantly stand a similar.

Oregon Jumbo Loan Costs

Oregon county conforming mortgage constraints are typical constant at the $726,200. By firmly taking aside home financing in the Oregon for this matter otherwise reduced, it is thought a compliant loan and is entitled to normal appeal cost. By taking away financing that's more than $726,200 to cover a property anywhere in the official, the loan would-be experienced a beneficial jumbo financing and will already been with a higher interest rate. Amazingly, jumbo financing costs are presently less than repaired cost.

Oregon Case Loan Pricing

Another type of financial choice is a variable-rates home loan (ARM). An arm always boasts a lesser rate of interest from the beginning when compared with a predetermined-rates home loan. One to rates can last for an introductory period somewhere within you to definitely and you can ten years. At the conclusion of the period, the pace can go up otherwise down one per year, but it constantly goes up. How often an interest rate can transform, as well as the maximum rate it does started to, is outlined from the loan's terms and conditions. It's important to check that interest cap before making a decision to your a supply, to know if it is something you can afford. Strangely enough, Case cost are currently more than one another jumbo rates and you will repaired cost.

Oregon Home loan Information

State financial assistance can be found to have homeowners throughout the Beaver State. Oregon Property and Society Features brings advance payment recommendations to have first-go out homeowners. Homeowners that have done a training path normally be eligible for up to $fifteen,000 for closing costs and you may down payment recommendations.

Offered Resources

Financing and you can features can also be found from the United states Institution away from Agriculture Outlying Creativity to own being qualified homebuyers for the outlying Oregon. You should check throughout your domestic lookup to find out if your cash advance usa loans in Northport AL qualify for one also provides.

Oregon Home loan Fees

Oregon homeowners which itemize deductions to their taxation is also deduct new mortgage appeal they pay all year round using their nonexempt earnings when submitting both federal and state income taxes.

Any worthwhile information to own Oregonians: It's not necessary to shell out import taxes into a residential property when you buy otherwise offer a property.

Oregon Home loan Re-finance

Oregon property owners who want to re-finance is also take into account the Higher Loan-to-Worth Re-finance Choice out-of Federal national mortgage association. Because the a part mention, our home Reasonable Refinance System (HARP) try , to make certain that has stopped being an alternative.

Leave a Reply