While this loans would be taken into consideration for financial cost checks, nothing is you to states you to that have a student loan usually end you against taking a home loan

- Pro Stuff

- First time People

Because the 2020 pandemic and you can next social distancing methods could have hindered the fresh new public sense typically regarding the college or university life, the latest hefty university fees charge are still a similar. Undergraduate pupils already pay out in order to ?9,250 annually to handle its programmes, although we have witnessed talk of your authorities slashing will set you back so you're able to send cheaper having students', the latest costs have been suspended up to 2022. How come accumulating it quantity of loans apply at students' economic wellbeing afterwards in the future, and much more especially, exactly what are the implications with respect to delivering a home loan? This informative guide features you covered.

Nothing is to state that that have a student-based loan tend to prevent you from getting a home loan. While this obligations installment loan company Nashville IL could well be taken into account for lender affordability checks, your circumstances total will determine your own eligibility.

Just like any financial, there are a number of activities on enjoy that may impression your application. The size of the put, credit rating, income, and how far the education loan and any other costs sets you right back per month, are just some situations.

Although it may be more difficult to find a toes to the house hierarchy when you yourself have a student loan, at some point lenders simply want warranty that one may pay for a mortgage near the top of your almost every other outgoings.

Handling a broker could be the best method off making certain your start the method securely, and you will purse many beneficial bargain for your private condition.

Do you know the has an effect on from college loans into the financial programs?

The good news is you to, though lenders needs student education loans under consideration whenever creating their research, these personal debt doesn't appear on your credit reports and will not adversely impact your credit score like other different borrowing would.

However, its a good essential that you allow your financial determine if you really have an educatonal loan, and the following advice might be declared on your own financial app:

- Exactly how much can be your student loan fees monthly?

Exactly how much you pay out 30 days toward student loan debt might have a giant impact on the quantity it is possible to borrow, so it is vital that you is it the remainder of your own monthly outgoings.

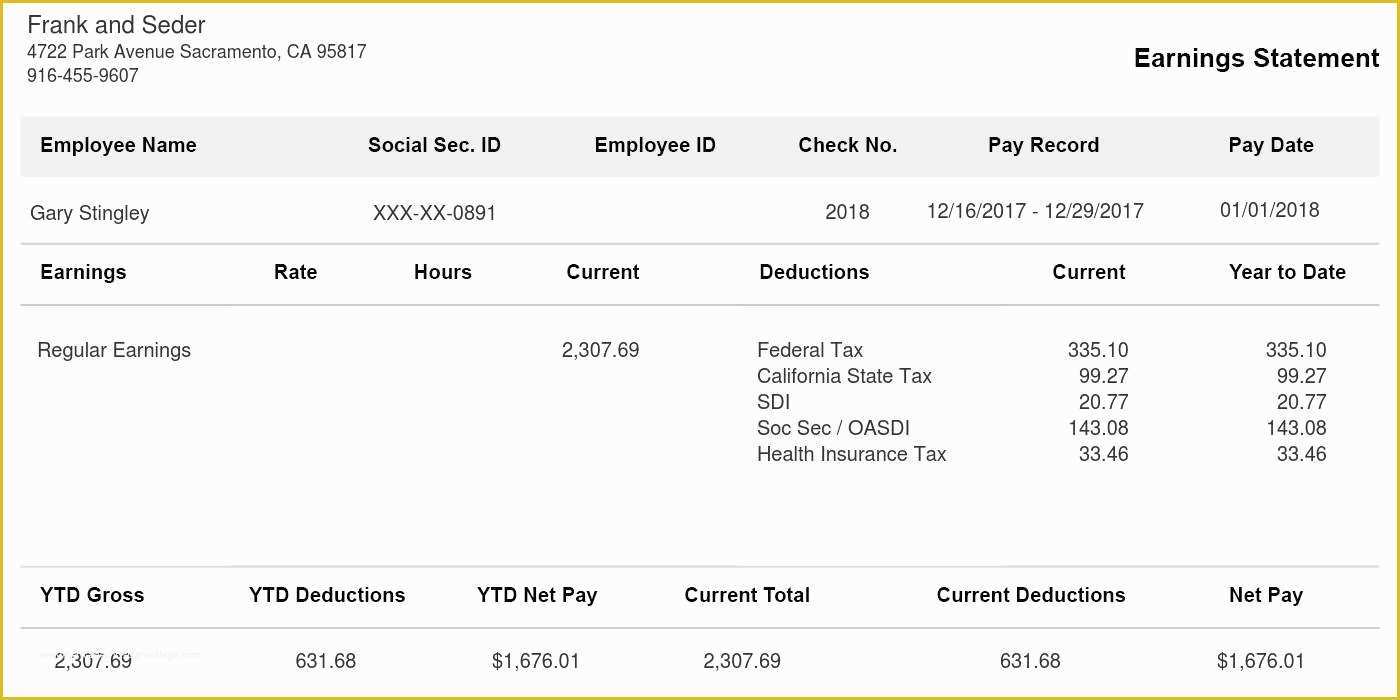

Education loan payments show up on their PAYE personnel payslips immediately together that have tax and federal insurance contributions, that are subtracted immediately according to your earnings. When you are thinking-functioning, student debt is actually reduced from the income tax program within the much the fresh new same way.

What you are left having just after these types of write-offs is the online pay, which is the shape lenders use inside value calculations.

In the event your PAYE money was adjustable due to extra otherwise percentage, the lender uses on average the final 90 days education loan costs due to the fact a connection.

- Just how much of your student loan do you have left to pay-off?

How much you've got left to settle of your student loan is also of great interest to loan providers, as the just like any forms of a good financial obligation, they wish to be aware of the total amount owed and how long it may need one pay it back.

Does an educatonal loan apply at the credit reports?

College loans are not appearing in your credit history, neither would it perception your credit rating, which makes them completely different from other sorts of borrowing. That being said, with one can possibly nevertheless impact debt reputation where bringing an effective mortgage can be involved.

Leave a Reply