The newest USDA Finance Wilmington NC, Ogden and you can Leland NC will not have chart change once the extreme while we very first consider. We knew a large number of neighborhoods manage cure the capacity to give the fresh USDA Home loan program in the event the charts improvement in however, we simply didn't know how larger (otherwise short) the change would definitely getting, up to we were in a position to actually see the Finally USDA Qualifications Chart to have Wilmington on future months.

What makes the fresh new USDA Map Alterations in Wilmington, Ogden and Leland NC a big deal? Well, USDA Mortgage brokers will be most affordable mortgage loans considering immediately. He has suprisingly low monthly USDA PMI fees (especially when you contrast them to FHA PMI Prices in Wilmington ) and need Zero advance payment! It is possible to utilize Maryland installment loans the NC Reasonable Housing Give program having a good USDA Financial, plus the MCC Income tax Borrowing from the bank.

- Our home need to be located within the USDA Qualifications footprint

- Credit scores have to be at the very least 600

- The household gross income for Wilmington, Ogden and you may Leland will be no higher than

- Group of 1 4 members $83,000

- Family unit members that have 5 or higher members $109,550

USDA Fund Wilmington

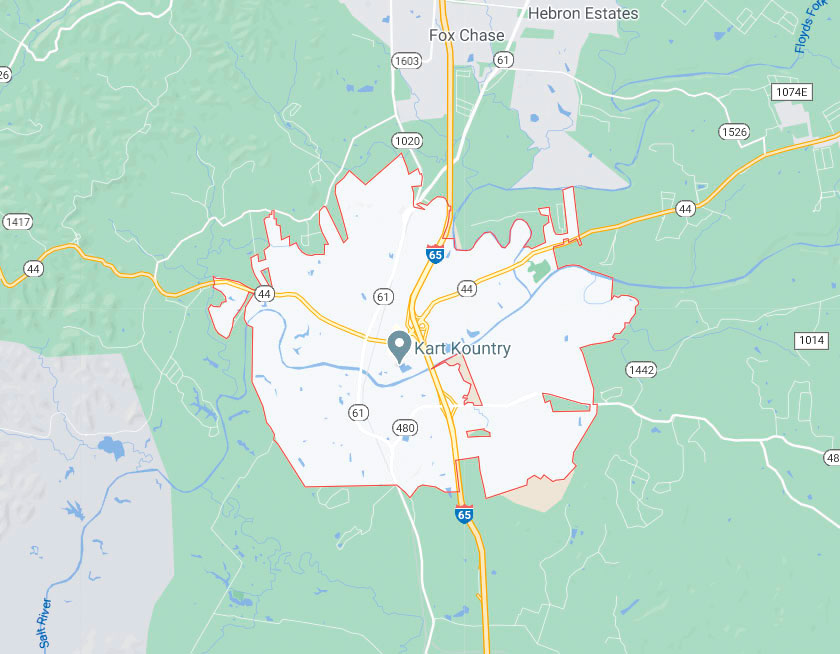

The fresh new shady section toward chart lower than dont qualify as the being for the USDA Home loan Eligibility area for Wilmington NC, but everywhere more do. You could clearly observe that Today every one of Leland, and much from Ogden qualifies towards system:

The new USDA Financial provides you with a unique opportunity that you you should never get that have any other kind out-of funds available to choose from. No money Off Home loan having relatively low closing costs. Because of this we think the fresh new USDA Mortgage provides you with the bucks to shut advantage! The one and only thing to look at that have USDA Money Wilmington (now) is the fact it entails an excellent thirty day period to get the mortgage from the Program.

This is the Exact same regardless of the home loan company you choose... it's a great USDA Underwriting specifications that all USDA Finance be seen of the a genuine USDA Underwriter. When you are with many fund, we can keep them recognized beginning to end from inside the 10 months USDA Funds take longer. Because of that, we often recommend that everyone look at the NC Grant System that gives very first time homebuyers Free Bucks to order an excellent domestic in the Wilmington NC area!

We read years back that mediocre amount of money called for to close good USDA Home loan Wilmington NC was in the fresh new selection of from the $575. If you were to contrast you to definitely in order to FHA otherwise Old-fashioned money, that is a significant difference of many thousand bucks; perhaps even tens of thousands of bucks in the closure.

College loans come in one or two groups: deferred and not deferred. And one thing to consider when looking at the newest USDA Mortgage Program would be the fact it can lose student education loans in different ways versus almost every other home loan applications offered. USDA Home loan Underwriters count a payment even though it is deferred (Unless we are able to document tomorrow percentage). In case it is deferred while the a full time income foot financing (definition the brand new fee in your education loan alter annually) they amount step one% of your balance.

Yep. This new upfront PMI one to USDA costs with the fund (called Initial Home loan Insurance coverage otherwise Be sure Percentage) will likely be as part of the mortgage. Because of this when you find yourself to invest in an excellent $100,000 home into the Raleigh, the loan is $102,000; Otherwise, you can pay the dos% from your pouch... or try to have the Supplier to blow they. We're not viewing of several situations where the vendor is doing that it, but when you features even more money, you could potentially feel free to shell out that it away from. Such as for example FHA, this new Ensure Payment (or Financial Insurance rates Fee) is not refundable.

Addititionally there is a yearly USDA PMI commission charged for a price regarding .5%. So you can estimate one you take your own total amount borrowed, so that the matter you are purchasing the house, imagine if it's $two hundred,000, in addition to dos% on the Initial USDA PMI that would feel $4000. Therefore, in this situation, $204,000 moments .5%. One to means $1020, which is the annual USDA PMI payment. Separate you to by the one year, together with month-to-month USDA PMI costs try $85.

USDA Finance Wilmington NC, Ogden and Leland

If you are considering a no money off home loan, or if you you desire addiitional information about the USDA mortgage settlement costs, or being qualified getting an excellent USDA Money Wilmington NC, telephone call Steve Thorne 919 649 5058 we perform those these mortgage loans per month inside NC!

Leave a Reply