Negotiate with the vendor to cover all otherwise area of the settlement costs after you build a deal. The greater amount of dollars you devote off while the a whole lot more you pay upfront, this new shorter they've to fund.

Obtain just what you want

Refinance your own home loan when you have repaid an adequate amount of your financing to-fall beneath the jumbo tolerance, where area you might refinance on the a normal loan at the less payment rate.

Just take a somewhat additional strategy

You could potentially reside in you to definitely unit and you may rent out one other. The borrowed funds will be based to the money off one another units, making it simpler in order to qualify for the mortgage. When there is one problems for the house when you are traditions indeed there, their renter's insurance rates will take care of it.

Talk to your moms and dads

If your parents have the mode and are generally prepared to help aside, you are capable be eligible for an excellent jumbo loan in the event the it co-to remain the loan to you.

They might and to enable cashadvancecompass.com/personal-loans-or/ you to get on a more affordable jumbo loan than just you can or even get.

Another option is actually for your parents to offer currency towards the the fresh down-payment so your amount borrowed isn't a bit so higher and you will makes it easier so you can qualify.

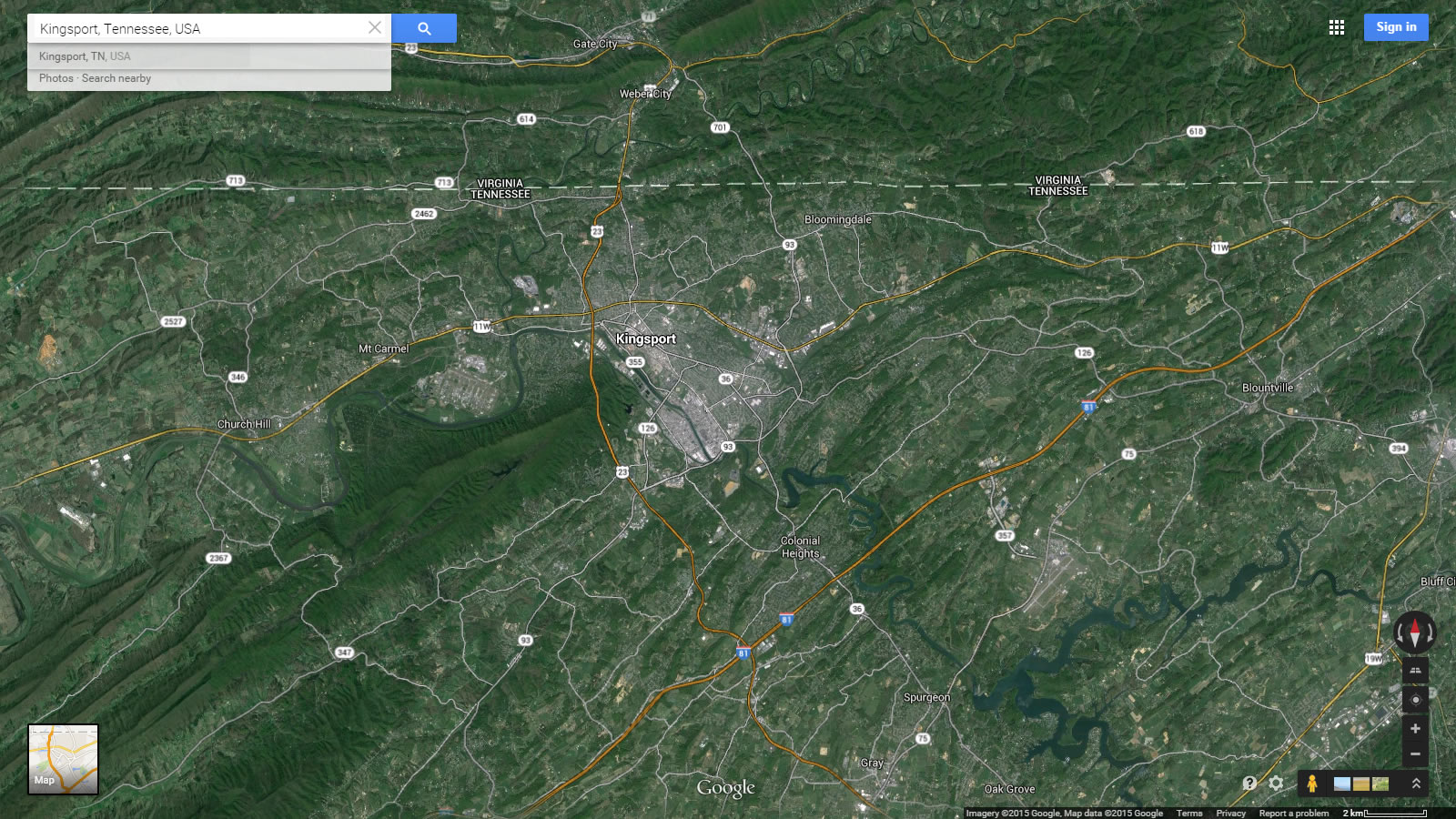

Go on to an affordable city

It's not necessary to real time at work - why-not proceed to a cheaper town, pick a home which have a traditional financing and book it out?

Jumbo Money Maximum Styles

Jumbo mortgage limits of the condition include high in the parts with a high median home values just like the loan providers can pass on the chance more a bigger level of shorter-costly residential property.

The mortgage community spends several procedures to have form the brand new compliant loan limitations you to definitely determine whether you've got a traditional otherwise jumbo financing. This type of tips will be the standard and you will ceiling for each and every condition.

This new baseline loan restrict is founded on the fresh new average family worthy of from inside the counties thought lower-rates construction locations, since the ceiling is dependent on the greatest-cost casing segments.

Jumbo mortgage limits have increased notably within the last long-time, making it easier to own borrowers to view jumbo money.

Jumbo funds wanted a more impressive downpayment that have more strict credit conditions than simply antique mortgage loans. Also it can getting more challenging to help you re-finance when you find yourself underwater towards their financial (definition, are obligated to pay more than it's worth).

The upfront records normally daunting, as numerous jumbo loan providers require extensive tax statements, financial comments, and you can practical software product.

You want lots of papers, whether or not you aren't thinking-functioning or do not have of several possessions, because the financial would like to check if you really have sufficient money on give to possess repairs, this new chairs, and you can settlement costs - of course, if.

This is when jumbo money are different out of compliant money: they might be riskier to have loan providers simply because they generally can not be resold since easily while the compliant financing can after they close.

Like most different kind regarding financing, jumbo money need to be underwritten based on rigid direction. Loan providers must pay attention on the credit portfolios and ensure that their consumers is creditworthy.

Nonetheless they need follow sensible lending strategies, particularly when giving jumbo finance (by the improved chance with the a more impressive amount borrowed).

Given this most scrutiny and much more mindful underwriting towards region out-of loan providers, of several professionals argue that jumbo loans is actually safer than simply shorter compliant finance. And indeed, jumbo financing haven't been at the center of every mortgage crisis lately.

However, given their quick business according to full mortgage loans, there's no genuine research that they're sometimes much more otherwise reduced safe than compliant financing.

Leave a Reply