An FHA mortgage are approved in place of a comprehensive and independent house evaluation. Still, it is preferable to get one over it doesn't matter, especially if you are worried about the condition of the home. An FHA financing try not to and won't romantic rather than a house appraisal, hence identifies industry worth and you may habitability of the house. An assessment, Maybe not a review Even if using a traditional home loan, the loan financial wants to verify the house is definitely worth the cost you will be spending. Brand new appraiser was acting as the new eyes of financial. Think about, an assessment isn't the same as a house evaluation. An evaluation are much more thorough. Houses is appraised on updates. For more information about this dilemma whilst relates to Conventional money, click on this link B4-1.4-08, Environment Danger Appraisal Conditions. But not, with FHA and Va financing, a well and septic review is always expected, no matter what visible condition of them systems. In the event the an examination doesn't admission neighborhood direction and requirements.

Why does a conventional loan work. At the its most simple, a loan was an amount of money your obtain to invest in a home.

Antique Financing: Advantages, downsides, and you will techniques for being qualified.

If you find yourself antique finance don't require property review, it's better to your visitors discover you to. A property evaluation report get let you know valuable information which can. What is an enthusiastic FHA Assessment and you can Appraisal? Generally, a mortgage lender demands an assessment of one's correct value of our home getting bought. This really is to make sure your house deserves the newest selling speed. To have a keen FHA mortgage, this new U.S. Company off Casing and you can Urban Creativity (HUD) demands it, and a review of one's residence's reputation.So you can violation evaluation, https://paydayloancolorado.net/fairplay/ our home need certainly to satisfy minimum protection. Household appraisals: In order to satisfy traditional mortgage requirements an appraisal required for a keen objective advice of a beneficial house's worthy of out-of a licensed possessions appraiser. However some borrowers who have a single-device domestic renders an advance payment out of 20% or even more as eligible for an excellent PIW assets examination waiver, and forget a home appraisal.

What's the Difference between an FHA Domestic Inspection and a beneficial.

This new Virtual assistant mortgage program doesn't need property evaluation, but it does wanted an appraisal. The new Va appraisal provides an important solution, but it doesn't ensure that the house is wholly clear of faults. Are told regarding real standing of the home you happen to be to find can safeguard you against costly fixes immediately after closing.

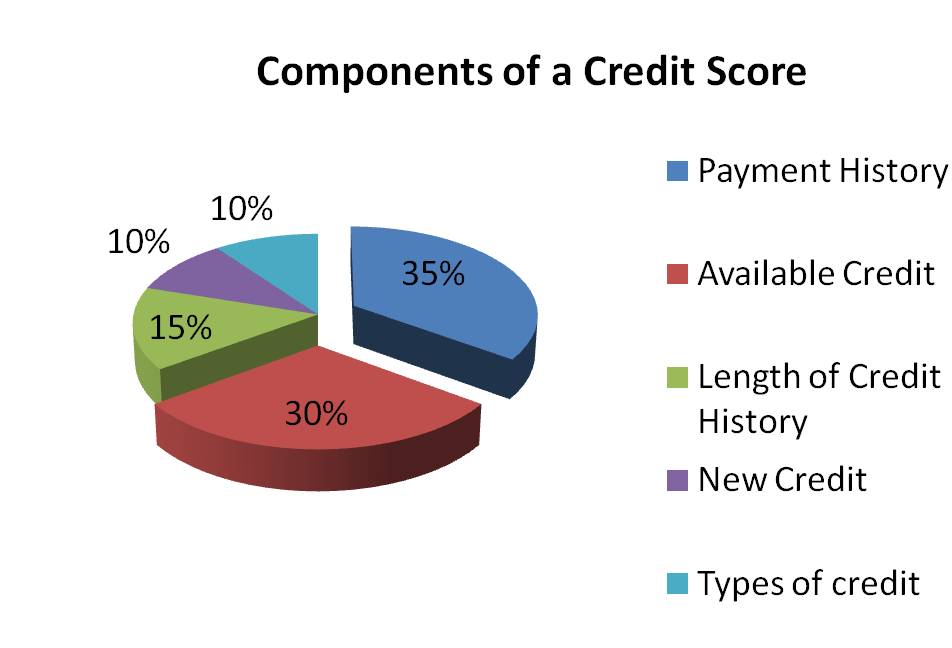

Home loan Approval Items: Your credit report.

For some antique financing, their DTI have to be 50% or straight down. Financing dimensions: To own a conforming traditional loan, your loan must slip inside loan restrictions lay by the Fannie Mae and you will Freddie Mac computer. The loan maximum alter annually. Having 2022, the brand new conforming financing maximum having an individual-family home are $726,two hundred. You'll find exceptions, yet not.

Old-fashioned Mortgage Appraisal Standards | Assessment Guidance.

Is a home evaluation required for my mortgage? No. Although not, your home check you can expect to imply solutions you to definitely property appraiser get require, particularly when you may be playing with a national-insured loan to invest in the home. Regulators credit recommendations has actually minimal assets criteria that must definitely be came across. Should your credit rating won't be considered your to have a normal mortgage, you will need a keen FHA loan. While doing so, if not set-out 20% an enthusiastic FHA mortgage are to you. FHA. New Va loan assessment criteria are simple, but shouldn't be drawn lightly. In the event the a property will not fulfill these conditions, you really have nice possible opportunity to fix one affairs. When your seller isn't happy to let, chances are your house isn't best for you, very remain looking. As well as, make sure you below are a few our very own other resources for the Virtual assistant money.

Leave a Reply