Italian laws formally recognises just certain brand of shelter and therefore give preferential legal rights towards a collector more no less than one assets of your grantor.

ipoteca': home financing in respect from immovable assets (belongings and you may property) and you can specific categories regarding registered movable assets (trucks, ships, aircrafts).

'pegno': a promise according from movable assets, claims and other assets. Such as for instance, it is common into the shareholder(s) within the a debtor business to convey a hope along side offers regarding the funded propco otherwise, getting individuals, to give you a vow more, inter alia, per family savings kept because of the borrower in itself in relation to the appropriate deal;

privilegio speciale' (around Article 46 of the Decree Zero. 385 of just one Sep 1993 of your own Republic out of Italy (Financial Law'): a floating charge more than introduce and you will coming movable features (not inserted inside a general public registry), belonging to a friends, to help you safe personal debt says not as much as a method or much time-label resource (having a span surpassing 18 months) granted by authorised banking entities. The categories of products in fact it is subject to a privilegio speciale are:

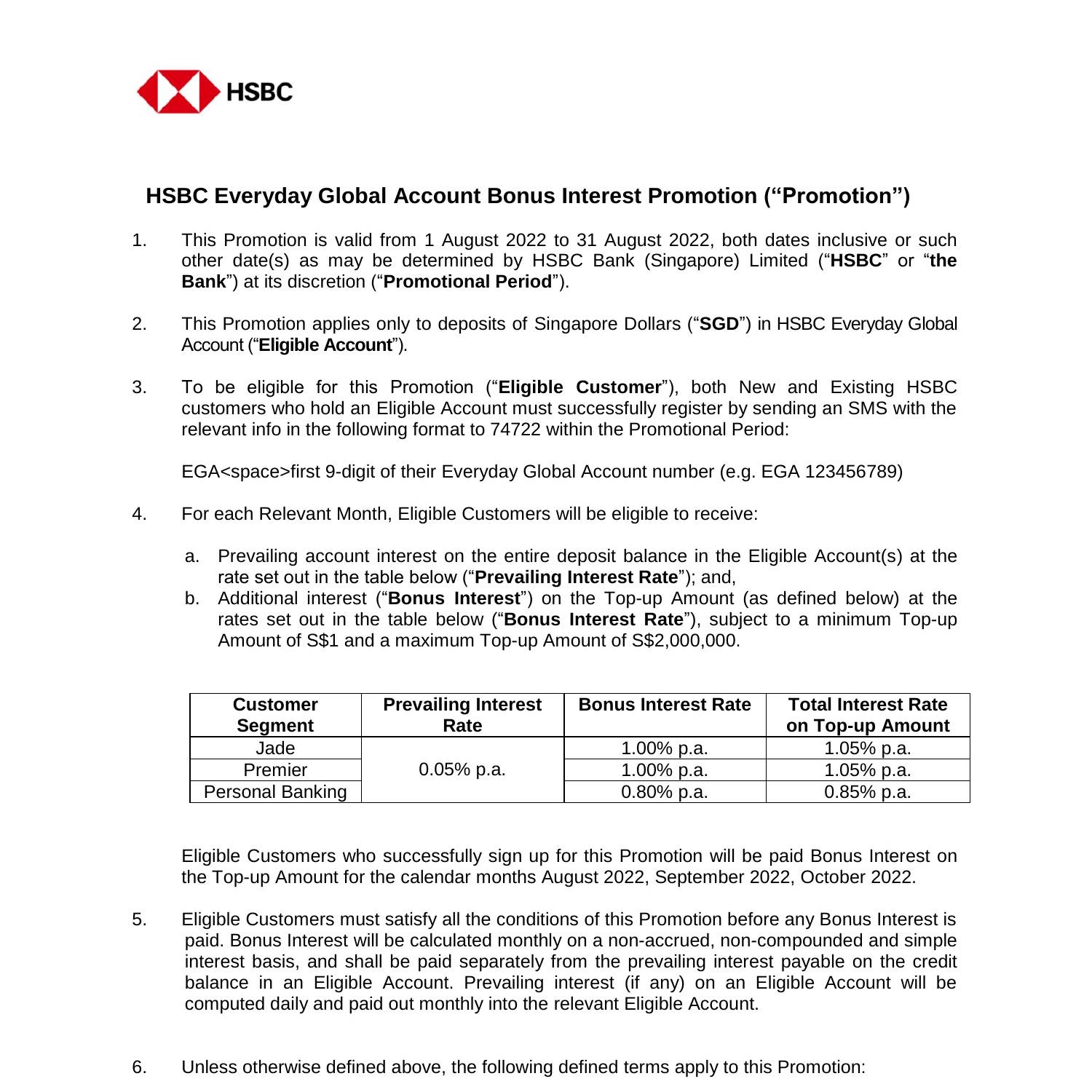

It coverage will be drifting protection more than a category of assets that the category of your own borrower's team changes away from time so you can some time and that can easily be thrown away instead of concur away from the lender

- recycleables, works-in-improvements, completed services and products, livestock and you may gift suggestions;

- services and products bought in one style to the continues of one's associated financing; and you will

- present otherwise online installment loans Mississippi future receivables as a result of transformation of property and you can items over specified

cessione di crediti inside the garanzia': a task from states as a consequence of defense is not technically a safety, however, a total import off name, although it could also be used (and is regularly utilized) given that cover. Relating to a genuine home capital deal, a project by way of safeguards generally speaking questions the liberties and you will receivables as a result of insurance coverage, work-related leases, due diligence reports and you can/or build contracts (when it comes to a property innovation).

Lower than these scheme, the new debtor(s) of one's assignor typically always spend to the borrower brand new number due to they up to a conference out-of default occurs, as well as the assignor undertakes to help you route any associated proceeds toward an effective checking account sworn in favour of the lending company.

The safety in the above list are created by separate cover documents or inside the financing agreement by itself (with the exception of the protection that have to be executed by the a composed deed before a great Notary public). The market industry important to possess prepared purchases, although not, usually offers up separate data.

Japan

The preferred variety of cover more real estate is financial (teitoken), together with as opposed to limitation, revolving home loan (ne-teitoken). Mortgage in general are a fixed charge and it also entitles the new mortgagee when deciding to take possession of your house and you may dispose of they having top priority while the facing other unsecured loan providers. Financial try perfected from the registration in the home otherwise building registries.

Frequently it's happening you to definitely shelter is actually provided over the leasing earnings regarding a home through a task for which this new renters is actually directed to blow the newest rental income toward financial, if necessary. Otherwise, a loan provider (bank) sometimes requires the debtor to start their bank account towards bank and also to have the tenants spend the money for leasing income so you're able to instance family savings therefore the lender could possibly get set off the loans contrary to the borrower, if required.

A corporate borrower may also do and you will prime having membership, protection as a result of transfer (jyoto-tampo) over property besides a residential property. Vow across the exact same assets is possible and for promise more than states, a subscription method is readily available. But not, to have pledge more than moveable assets, a subscription system is not available. Frequently it's the case you to definitely a lender requires each other mortgage more real estate and you may coverage as a result of transfer otherwise hope over other assets inside or about the actual home.

Leave a Reply