By the Amanda Dodge

For some Us citizens, to acquire a property looks like an aspiration which is out-of the arrive at if they have little money conserved otherwise possess a leading earnings peak.

Most people under the age of 35 have a average deals away from $5,eight hundred, which is usually set aside for their emergency fund. Fortunately, you can still buy a house if you are working on your down payment and want to invest in your future.

This informative guide will target how-to pick a property having reasonable earnings and no down-payment when you find yourself bringing multiple choices to thought.

Discover multiple federal and state apps you can attempt in the event that you are interested in property. Specific loan providers and additionally specifically focus on lowest-money buyers. Realize about the options and create plans of action. Pursue these actions in order to become a resident while still-living in this the setting.

Government-Supported Mortgage Applications

You can find numerous applications built to service consumers that have brief off costs otherwise don't want to clear out its coupons in order to pick a home.

There's a common misconception that you need to save 20% of the home's value for a down payment. In reality, most people just put 6% so you're able to seven% down. Depending on the loan you get, you might only need to put 3.5% down, making purchasing a home much more affordable.

Whether your average family rate towards you is actually $three hundred,000 upcoming a beneficial 6% advance payment is $18,000. For many who lay out step 3.5% included in an FHA loan, you just you desire $ten,500.

Know that low down costs include disadvantages. The fresh smaller you put off, the greater the home loan could well be. Also, if for example the advance payment was below 20% of the residence's really worth, try to spend private mortgage insurance policies (PMI) inside your payment. Work with your Real estate professional to be sure so it drops within your budget.

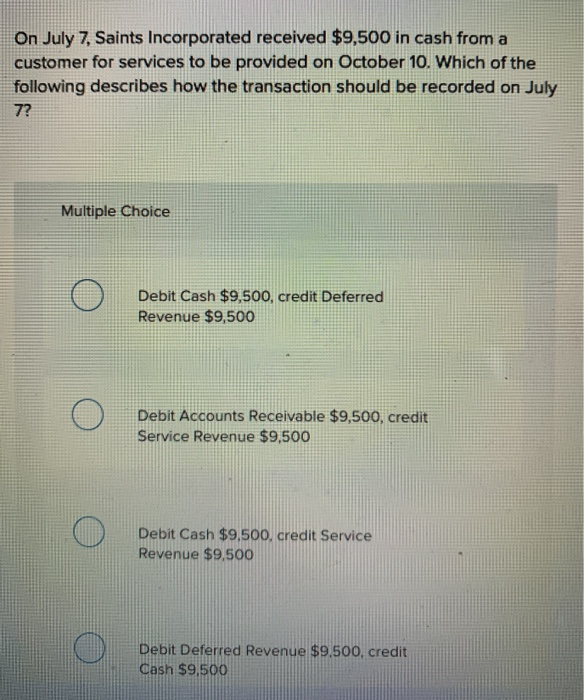

Here are some apps to look towards the as you research to have loans that provide brief downpayment choices. Pick those you qualify for.

Federal Houses Administration (FHA) Funds

If you are ready to buy your first home, look into FHA loans. This type of finance are designed to help people with small down payments become homeowners. They have low closing costs and easy credit for qualifying. You will work with a traditional lender to receive an FHA loan and they will broker the mortgage.

If you have a credit score over 580, you will simply need contribute 3.5% of your residence's value getting a down payment. Should americash loans Good Hope your credit score is a lot more than 500 but lower than 579, you will need to lead 10% of residence's purchase price.

Check your credit score and determine if you would like raise it across the next season prior to purchasing property otherwise as much as possible keep the loan that have a good ten% advance payment. One of the benefits from opting for a good 10% down payment is you save on mortgage insurance policies from the long term.

Veterans Benefits Management (VA) Money

If you are an active service member or veteran who qualifies for benefits, you may be able to submit an application for a good Virtual assistant financing. These loans often come with no down payment requirements, which is ideal for veterans without a lot of savings. There are also limited closing costs and no private mortgage insurance.

A portion of the difference between Va finance and you will FHA funds (apart from new armed forces official certification) is that you can make use of this work for several times. You are able to Va money when you sell your house and are interested most other of those in numerous parts of the country.

Leave a Reply