Dismiss circumstances are costs you have to pay into financial in order to reduce steadily the total rate of interest. For each and every area means one percent of the rate of interest, as there are usually a limit out of two points.

If you plan in which to stay your house for a long big date, to get points will save you money during the period of the newest mortgage. For many who you are going to circulate within this a couple of years even if, you're best off sticking with the higher interest.

Settlement costs tend to be origination fees, agent costs, credit file costs, deed-tape, term insurance rates, studies, taxation, and you may appraisal charges. Their bank will be leave you an estimate of prices in this three days of your loan application.

Normally, the buyer pays most of the settlement costs. However, certain people can be negotiate therefore, the seller will pay certain or every settlement costs. You may through the closing costs in your mortgage or pay certain or almost everything up front.

twenty-five. What exactly is escrow and how can it works?

You'll likely tune in to the definition of escrow used for several aim from inside the a residential property. When you look at the conversion process techniques, the buyer may need to put cash on the an escrow membership once they wade not as much as price. It is normally anywhere between $250 and you may $500 and you can will act as an effective-believe payment. The vendor perform place the action toward domestic inside the escrow at this time. The cash regarding membership visits closing costs or even the purchase of our house toward closure.

Some lenders might need one to a citizen explore an escrow account to get towards the property taxation and you will insurance. Should this happen, new escrow loans is generally integrated into their payment.

twenty six. How long does it attempt intimate a home loan?

Each deal is different. Although not, the typical time between going significantly less than offer to help you closure was four so you can six weeks. Problems from the software procedure, or missed work deadlines, can prolong the method.

twenty seven. How does they just take such a long time to close a home loan?

There are a few procedures which go into the closure with the a house together with inspection and you can appraisal. The lender then must make sure our house has actually a definite name (zero liens of creditors) in advance of they'll leave you money for the property.

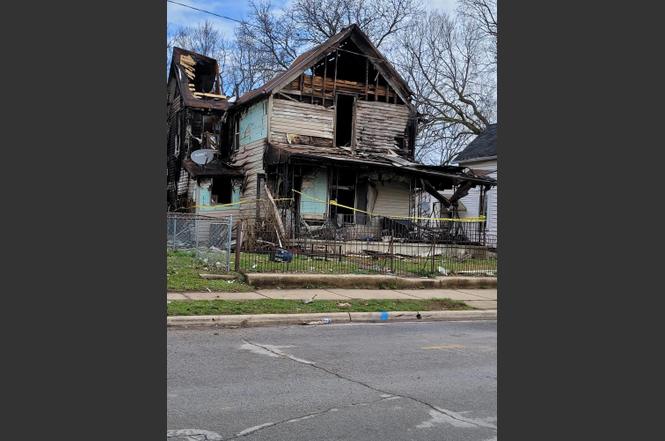

During the all of our crisis out of a home appear, i made an effort to get a house that has been from inside the property foreclosure. 3 months toward process we nonetheless hadn't signed because the financial kept seeking alot more liens.

?? Advisable that you bear in mind: Foreclosures may take forever, so if you're deciding on that type of possessions, patience is key.

Pursuing the name search, appraisal, and you will check, the mortgage goes through underwriting. This is going to be frustrating if the bank desires additional documents. Remember that multiple folks are addressing the financial as well as the shuffle can also be expand the amount of time it needs also.

twenty-eight. How much time does it decide to try process my personal loan application? Could there be a make certain that it will romantic promptly?

It depends. From the most useful-situation circumstances, you have a decision in your home mortgage inside the 72 period. Which initial acceptance is probably conditional, definition most files must be offered before final choice was last. More often than not, that it other files has an evaluation and you may appraisal.

As far as promises wade unfortunately, there are not any claims. If your due date is getting a tad too close getting morale, you could ask the seller having an expansion. Very providers will most likely agree to let make certain loans Berry AL a silky procedure. Signing a lot more documentation needs quite often, nonetheless it can also get you a few more months or days towards lender to end the end of your contract.

Leave a Reply